販売価格:¥500.00円¥360.00円 (税込)

商品説明

宙のまにまに Vol.3 (初回限定版) [DVD]

: 宙のまにまに Vol.1 (初回限定版) [DVD] : 前野智昭

: 宙のまにまに Blu-rayBOX(Blu-ray

宙のまにまに』がイベント開催!プラネタリウムで感動生解説

TVアニメ「宙のまにまに」公式サイト | マーベラス

TVアニメ「宙のまにまに」公式サイト | マーベラス

宙のまにまに(1) | 柏原麻実 | 無料漫画(マンガ)ならコミック

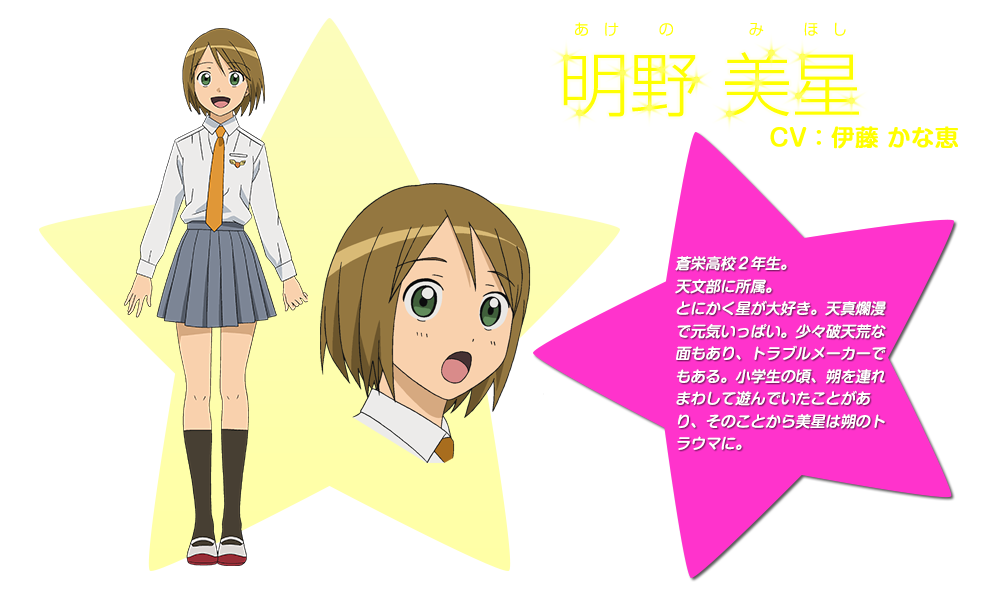

宙のまにまに|アニメ声優・キャラクター・登場人物・動画配信情報

: 宙のまにまに Blu-ray BOX : 前野智昭, 伊藤かな恵

365recettes.com

- 347 942 0721

- sale@365recettes.com

(c) 2018 Asd Ritmica Dynamo | Privacy Policy & Cookie Law

販売会社/発売会社:(株)マーベラスAQL((株)ソニーピクチャーズエンタテインメント)

発売年月日:2009/09/25

JAN:4535506708373

規格品番:MJBD70837

柏原麻実原作コミックをアニメ化した青春グラフィティ。幼いころ過ごした町に戻ってきた大八木朔が蒼栄高校に入学し、そこで幼馴染みの美星に再会。彼女に誘われ天文部へ入った彼が、次第に星空を愛するように……。//特典~ラジオCD1枚付