- ホーム

- レディースファッション

- バッグ・雑貨

- 財布・ポーチ

- 長財布

- BALENCIAGA バレンシアガ BALENCIAGA ラウンドファスナー長財布 メンズ レディース アウトレット 51

BALENCIAGA バレンシアガ BALENCIAGA ラウンドファスナー長財布 メンズ レディース アウトレット 51

販売価格:¥64690.00円¥33630.00円 (税込)

| メーカー/原産地 | 商品の状態 | 新品 | |

|---|---|---|---|

| 発送国 | 国内 (日本) | ||

| 平均配達日数 | |||

| 材料/素材 | |||

| 決済方法 | VISA, MasterCard, JCB card, PayPal, LINE Pay, コンビニ決済, Suica決済, あと払い(ペイディ), 銀行振り込み, ネットバンキング, Qサイフ | ||

| A/S情報 | A/Sセンターおよびメーカーまたは販売者にご連絡ください。 | ||

| 返品/交換 | 商品ページ上の詳細やお知らせ・ご注意を参考してください。 | ||

バレンシアガ/BALENCIAGA [ 財布 ] サイフ CLASSIC

カード入れやポケットが充実しているので収納バッチリ!機能性とファッション性を両立した長財布です!

カード入れやポケットが充実しているので収納バッチリ!機能性とファッション性を両立した長財布です!

|

*掲載商品は実店舗及び他店舗でも同時販売しております。その為、ご注文を受付けた場合でも在庫調節のズレにより品切れとなる場合が御座います。

*掲載写真は撮影やパソコンの環境により、実物と異なって見える場合がございます。

*表記サイズは採寸用サンプルの実寸値となりますので、お届け商品と表記寸法の間に多少の誤差が生じる場合がございます。ご了承ください。

バレンシアガ BALENCIAGA ハンド・トートバッグ NAVY NEW CABAS SM

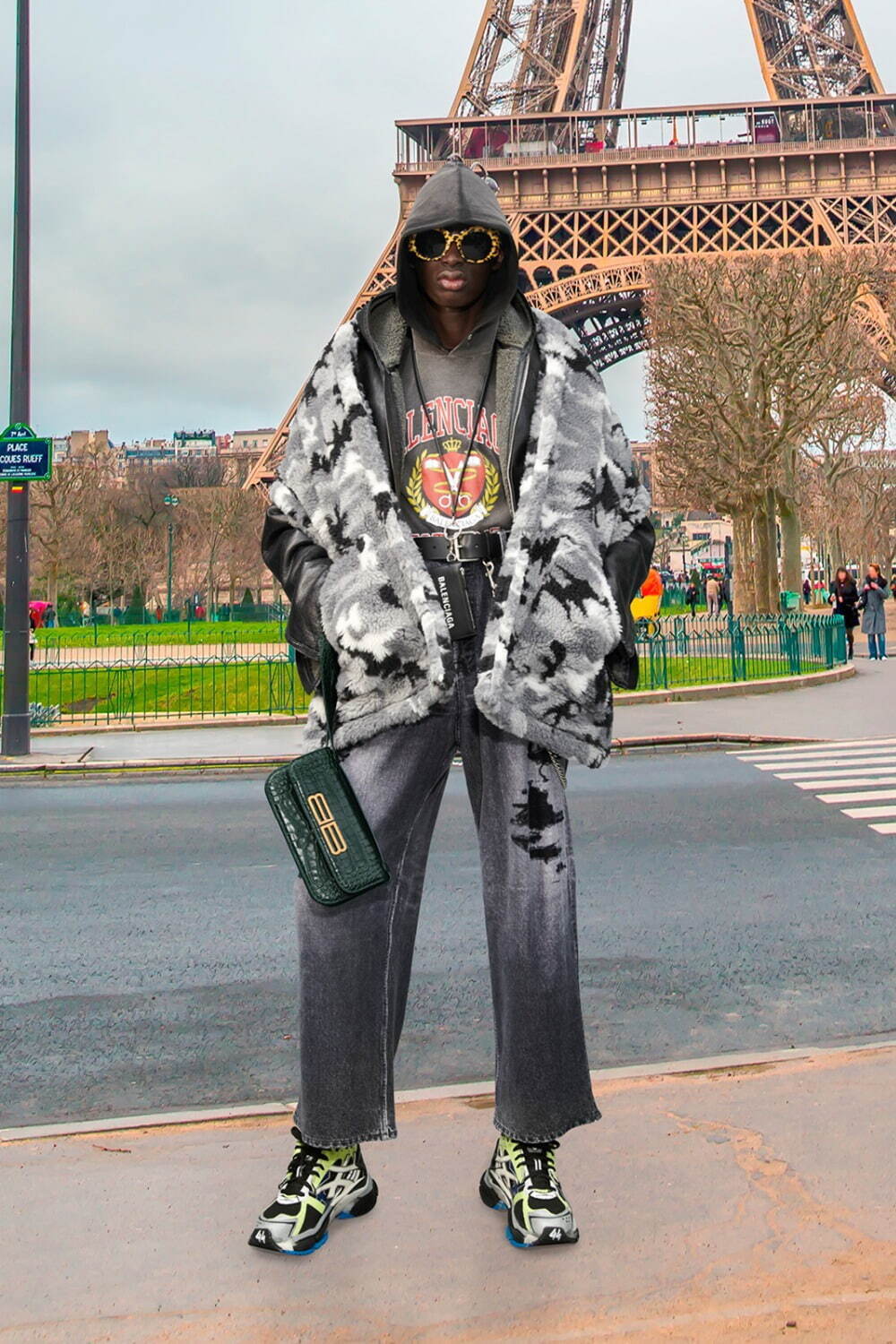

バレンシアガ(BALENCIAGA) 2021年冬ウィメンズ\u0026メンズコレクション

写真1⁄24|「バレンシアガ」銀座初の旗艦店オープン、メンズ

バレンシアガ BALENCIAGA バック (グレー) -waja bazar - 海外

バレンシアガ ショルダーバッグ PUFFY COATED ブラック メンズ

バレンシアガ ショルダーバッグ ハンドバッグ ミニショッピングバッグ

バレンシアガ ショルダーバッグ ショッピング ハンドバッグ フォン

バレンシアガ BALENCIAGA トートバッグ ネイビー カバ スモール レザー バッグ NAVY CABAS S 339933 D6WXN | フリマアプリ ラクマ

バレンシアガ(BALENCIAGA) - 2024-25年秋冬コレクション | SPUR

バレンシアガ 2024年春コレクション |

バレンシアガ(BALENCIAGA) 2024-25秋冬コレクション | ファッション

365recettes.com

- 347 942 0721

- sale@365recettes.com

(c) 2018 Asd Ritmica Dynamo | Privacy Policy & Cookie Law