販売価格:¥65000.00円¥32500.00円 (税込)

商品詳細

ホンダ/カワサキ 人気モデル···Z1/Z2

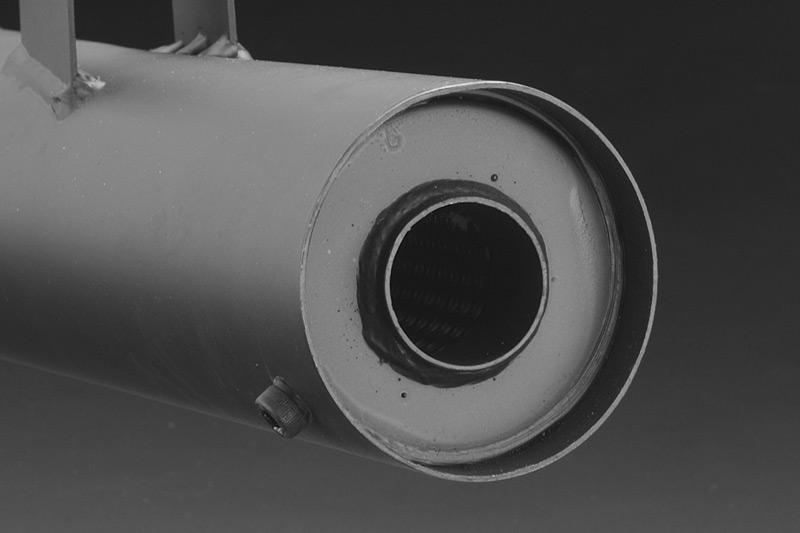

PMCのNo.86-165の中古商品です。

傷、汚れはありますが凹みや大きなガリ傷、サビは有りません。Z750D1に装着していました。

音もあまりうるさくも静かでも無く自分的には良い音だと思います車検もOKでした(都道府県で違う可能性あり)

マフラーフランジ6から8に加工しています。Z IIの6スタッドに取付する場合は6のW/Cかカラーが必要です。

取付のボルト、ナットは付属していません

商品の情報

| カテゴリー: | 車・バイク・自転車>>>バイク>>>パーツ |

|---|---|

| 商品のサイズ: | |

| ブランド: | ピーエムシー |

| 商品の状態: | 傷や汚れあり |

| 配送料の負担: | 送料込み(出品者負担) |

| 配送の方法: | 未定 |

| 発送元の地域: | 長野県 |

| 発送までの日数: | 4~7日で発送 |

最終 当時物 希少 ヨシムラ 初期型 手曲げ マフラー Z750RS Z1 Z2 D1

Z1⁄Z2 初期型手曲げ管 | 株式会社ピーエムシー|カワサキZ

バイク用マフラー z2 z1の人気商品・通販・価格比較 - 価格.com

Z1 マフラー 手曲げ(マフラー|パーツ):バイク用品\u003c車

PMC製 38φ 初期型手曲げ管 スチール製 直管マフラー 入荷しました

KAWASAKI,Z172-75,排気系(マフラー等) | 株式会社エムテック・中京

KAWASAKI,Z172-75,排気系(マフラー等) | 株式会社エムテック・中京

Z1⁄Z2 BRC手曲げショート管マフラー(黒) \u203bバッフル脱着可能 | KAWASAKI

365recettes.com

- 347 942 0721

- sale@365recettes.com

(c) 2018 Asd Ritmica Dynamo | Privacy Policy & Cookie Law