販売価格:¥295000.00円¥141600.00円 (税込)

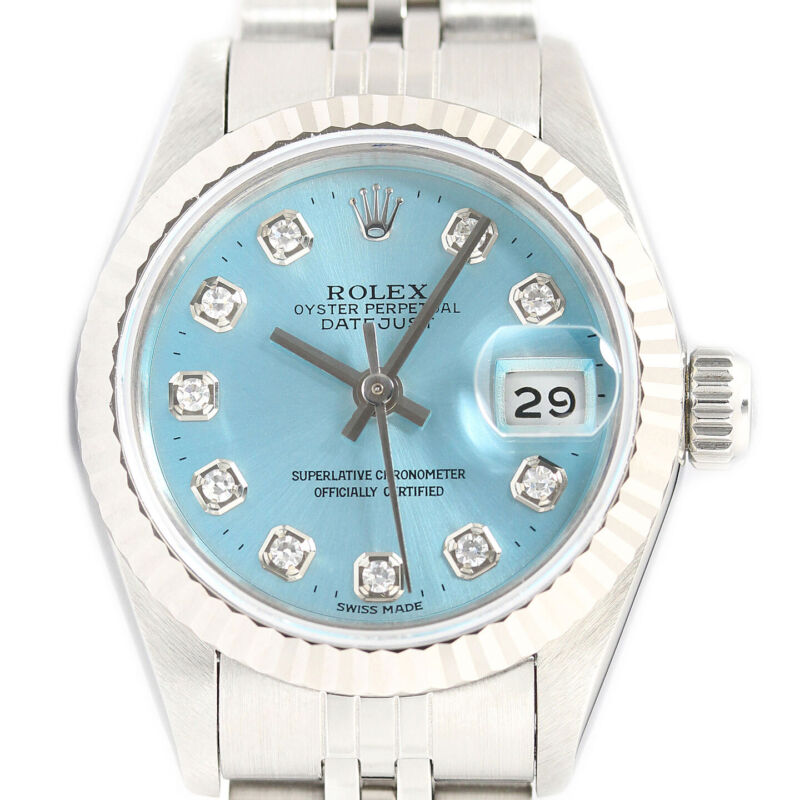

品名:ロレックスROLEXオイスターパーペチュアル 18KWGベゼル レディース自動巻き

品番:67194

シリアル番号:U672116

ケース径:約24mm

腕周り:約15.5cm

付属品: (画像の物のみ)ロレックス純正箱 日本ロレックス保証書 小冊子

ランク:A

備考:

・自動巻き

・日本ロレックス保証書

・古物商鑑定済み

・K18ホワイトゴールドベゼル

S 新品・未使用

A 多少の使用感

B 一般的な使用感

Cかなりの使用感

21W-029

品番:67194

シリアル番号:U672116

ケース径:約24mm

腕周り:約15.5cm

付属品: (画像の物のみ)ロレックス純正箱 日本ロレックス保証書 小冊子

ランク:A

備考:

・自動巻き

・日本ロレックス保証書

・古物商鑑定済み

・K18ホワイトゴールドベゼル

S 新品・未使用

A 多少の使用感

B 一般的な使用感

Cかなりの使用感

21W-029

ゴールド(ブランドロレックス)(レディース腕時計|腕時計

ROLEX ロレックス パールマスター 80318 YG⁄WG イエロー

ロレックス レディース デイトジャスト Ref. 69174 18Kホワイト

ロレックス レディース デイトジャスト Ref. 69174 18Kホワイト

ロレックスデイトジャスト ホワイトゴールドを購入 | Chrono24 高級

K番 2001年頃製造品 ROLEX ロレックス デイトジャスト ダイヤベゼル 179369 ホワイト文字盤 ホワイトゴールド レディース 女性用 自動巻時計473

ロレックス レディース デイトジャスト Ref. 69174 18Kホワイト

ロレックス レディース デイトジャスト Ref. 69174 18Kホワイト

ロレックスのベゼルにはどんな種類があるの? フルーテッドベゼル

美品K18婦人時計レディース ロレックス エメラルド ダイヤ ベゼル

ロレックス 腕時計(レディース)(シルバー⁄銀色系)の通販 800点以上

ROLEX - ROLEXロレックス デイトジャスト オイスター

幻の逸品18金無垢ホワイトゴールド☆ロレックス レディース 純正26

K18(ブランドロレックス)(レディース腕時計

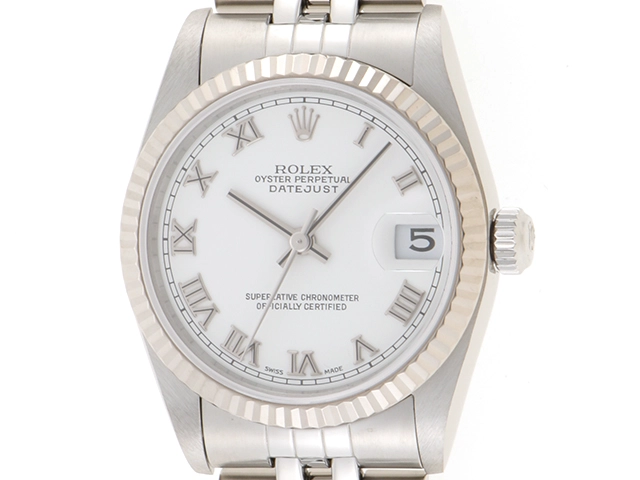

ROLEX ロレックス デイトジャスト 78274 自動巻き

ROLEX ロレックス デイトジャスト 78274 自動巻き レディース ホワイト

365recettes.com

- 347 942 0721

- sale@365recettes.com

(c) 2018 Asd Ritmica Dynamo | Privacy Policy & Cookie Law